Is Integrity a Criterion — or an Excuse for Inaction?

Integrity has become the defining word of the voluntary carbon market (VCM) in recent years. Every standard references it, buyers increasingly demand it, and headlines question it. But somewhere along the way, integrity has begun to serve two competing roles: as a genuine quality benchmark and, at times, an unintended justification for hesitation or inaction.

This tension is understandable. Integrity matters deeply. Yet when the conversation becomes dominated by concerns—over-crediting, baseline disputes, inconsistent verification—it can unintentionally reinforce the perception that the entire system is fundamentally flawed. These issues are real, and addressing them is critical. But focusing almost exclusively on shortcomings risks overshadowing the progress, the learning, and the real climate and community impacts that well-designed projects continue to deliver.

The consequence is familiar: many buyers now prefer to wait for “perfect clarity” before engaging, and some developers hesitate to invest in new landscapes. The result is not a deliberate freeze, but a slowdown—a caution that sometimes goes beyond risk management and begins to delay action.

Integrity Is More Than “Good Carbon Accounting”

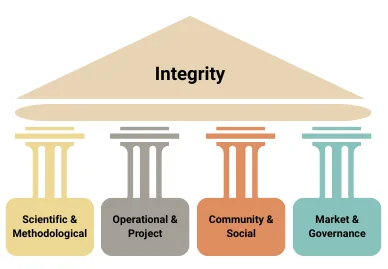

Most conversations about integrity begin—and end—with carbon numbers. In reality, integrity in carbon markets has four interconnected layers:

- Scientific and methodological integrity

- Operational and project integrity

- Community and social integrity

- Market and governance integrity

A credit is only as strong as the weakest of these pillars. And improving them requires active engagement, not withdrawal.

A Helpful Analogy: Match-Fixing Did Not End Sports

History offers guidance.

Cricket, football, cycling, and athletics have all faced severe integrity challenges—match-fixing, doping scandals, governance failures. Yet no one suggested abandoning the sport until perfect integrity was guaranteed.

Instead, governing bodies strengthened rules, created anti-corruption units, introduced independent oversight, adopted new technologies, and expanded athlete education. Players adapted, institutions adapted, and the sport became stronger. Integrity failures served as catalysts for reform, not reasons to stop playing.

Carbon markets deserve the same treatment.

If a REDD+ programme reveals weaknesses in baseline setting, leakage modelling, or community governance, the answer is not to dismiss all REDD+ activities. It is to improve methodologies, strengthen monitoring, invest in verification quality, and reinforce community institutions. Integrity should be seen as an ongoing process—one that evolves with evidence, not one that expects perfection before action.

What Integrity Means in a REDD+ Project

For REDD+ projects, integrity spans the full project lifecycle:

- Baseline integrity: Are deforestation risks real, well-evidenced, and conservatively modelled?

- Additionality: Is carbon finance genuinely enabling protection that would not otherwise occur?

- Community integrity: Are FPIC processes robust? Are governance structures inclusive? Are benefits transparent and equitable? Is there a functional grievance mechanism?

- Monitoring integrity: Do patrol logs, satellite imagery, leakage assessments, and field verification align?

- Verification integrity: Are auditors applying rigour, independence, and transparency? Are CARs and CLs addressed meaningfully?

- Permanence integrity: Are risks such as fire, pests, encroachment, and tenure uncertainty well-analysed and buffered?

When these components work together, a REDD+ credit can reflect meaningful climate mitigation and real community benefit. But building this level of integrity is not cost-free.

Who Pays the Price of Integrity?

In practice, the costs of high-integrity systems are distributed unevenly.

- Buyers often manage risk through caution—slowing purchases or narrowing their portfolios. Their primary cost is reputational, not livelihood-related.

- Standards and verifiers face increasing expectations, governance pressure, and scrutiny from multiple stakeholders.

- Developers absorb rising monitoring demands, higher verification fees, more complex documentation, and years of upfront investment before the first credit is issued.

But the greatest impact is felt by communities.

When markets hesitate, revenue-sharing slows, patrol teams shrink, livelihood programmes reduce, and local trust in climate finance weakens. Forest-protecting communities do not pause their work when the market slows; stewardship continues regardless of global sentiment. But without predictable finance, that stewardship becomes harder to sustain.

Integrity Should Drive Action, Not Stall It

Integrity is non-negotiable for a credible market. But when used—intentionally or not—as a reason to delay climate action, it risks harming the very people safeguarding the landscapes we rely on for climate stability.

The goal should not be perfect markets, but continuously improving markets—ones that maintain high standards while still ensuring that climate finance reaches the ground.

A carbon credit represents more than a tonne of CO₂e.

At its best, it is a high-integrity carbon credit—one that represents community stewardship, forest protection, long-term livelihood security, and a measurable climate contribution.

The market must honour that—not by demanding perfection, but by rewarding integrity that is demonstrated in practice, on the ground, by real people and institutions committed to protecting their landscapes.